15 Essential Reasons Every Dog Owner Needs Pet Insurance

One minute, your dog is chasing a squirrel full of energy; the next, they’re limping back to you. Pet insurance can be a lifesaver in those unexpected moments, covering care costs without adding financial stress. With countless benefits, here are 15 essential reasons every dog owner needs pet insurance.

Protecting Against Unanticipated Vet Bills

Veterinary care can become expensive quickly, especially in emergencies. An unexpected illness or accident can quickly result in thousands of dollars in veterinary bills. Pet insurance helps cover the costs, so you won’t have to choose between your pet’s health and your wallet.

Coverage for Chronic Conditions

Chronic illnesses like diabetes and arthritis can require long-term interventions, including medications, special diets, and frequent vet visits, which can add up quickly. Specific pet insurance plans help manage these ongoing costs by covering some treatments, tests, and care.

Flexibility in Choosing a Veterinarian

Unlike some human health insurance plans, pet insurance usually lets you visit any licensed vet. This flexibility means you’re not restricted to a particular network, which makes it easier to find the best support for your furry friend without worrying about additional costs or approvals.

Helps Budget for Routine Care

Many pet insurance policies cover preventive care, such as vaccinations, dental cleanings, and flea remedies. Early detection of health issues through these services can minimize the likelihood of costly treatments later. By covering routine care, policies allow for better financial planning and extend a dog’s lifespan.

Travel Protection

Pet insurance can be a lifesaver when traveling across states or internationally. Several policies extend coverage if your dog is injured while away from home. Knowing you’re covered in unfamiliar places helps relieve the stress of traveling with your furry companion.

Covers Expensive Surgeries

Surgical procedures, such as ligament repairs or tumor removals, can pose a significant monetary challenge for many pet owners. Pet insurance helps cover many of these costs, including surgery, medications, and follow-up care. This financial relief lets you prioritize your dog’s recovery.

Financial Protection Against Damages

Accidents happen, and when your dog damages property or harms someone, third-party liability cover steps in to shield you from economic strain. Liability fees and compensation claims are often included, with policies offering substantial coverage, ensuring protection in public spaces.

Unforeseen Illnesses Happen

Even the healthiest dogs can unexpectedly fall ill. Genetic conditions or sudden issues like cancer can result in hefty medical bills before you know it. With insurance in place, those costs are much more manageable, so your dog gets the necessary care, and you aren’t overwhelmed by the same.

Helps With Behavioral Treatments

Behavioral issues, such as anxiety or aggression, sometimes require professional intervention, including medication or therapy. Some pet insurance plans cover these interventions, allowing you to address behavioral problems without worrying about the financial cost.

Long-Term Savings

Although monthly premiums might feel like an additional cost, pet insurance can lead to long-term savings by lowering outlays for major medical treatments. Insurance coverage can reduce large medical bills for emergencies or serious health problems, giving you more value for the care your dog receives.

Protection From Rising Veterinary Costs

Veterinary care has become more expensive, making it harder for some owners to afford essential remedies. As vet bills climb, insurance helps cover a huge portion, letting you prioritize your dog’s care without worrying about costs. This financial support ensures your pet receives timely medical attention.

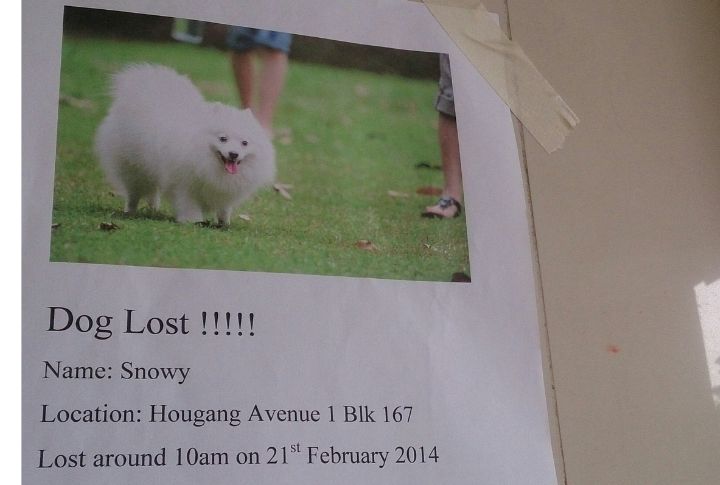

Helping Bring Your Dog Home

Specific insurance plans offer lost and found cover if your dog goes missing. This coverage assists with the cost of advertising and may even provide a reward to encourage your pet’s safe return. In some cases, owners can also be reimbursed for recovery expenses, making the process less stressful.

Coverage for Prescription Medications

Medication expenses, especially for prolonged treatments, can add up quickly. Many pet insurance plans cover prescription medicines, offering financial relief when managing ongoing care for your dog. This support allows you to prioritize procedures that improve your pet’s life without high costs.

Flexible Plans to Fit Your Needs

Pet insurance providers often allow you to tailor coverage to meet your dog’s unique requirements. Whether you need accident-only protection or a comprehensive plan that includes wellness care, you can choose a policy that aligns with your budget while still providing your pet with the right level of care.

Saying Goodbye With Support

Losing a beloved pet is emotionally draining, but it doesn’t have to come with additional monetary stress. Farewell cover assists in easing the budgetary burden of end-of-life care, and policies often include expenses related to euthanasia, cremation, or burial. Coverage typically extends to a set limit.